Desktop House Valuation: The Complete Guide to Modern Property Assessment in 2025

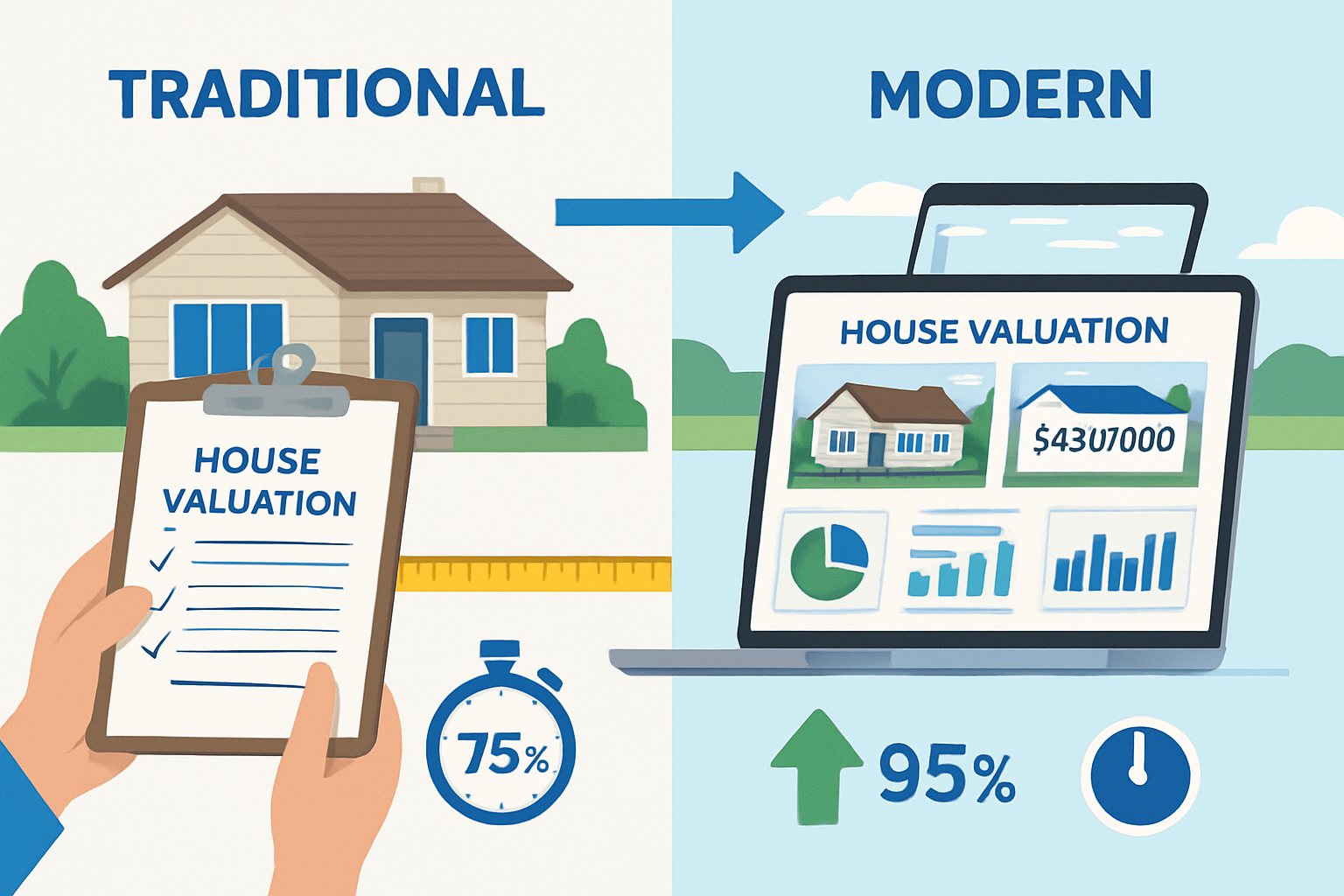

In today’s fast-paced property market, waiting weeks for a traditional valuation can mean missing out on crucial opportunities. Desktop house valuation has revolutionized how properties are assessed, offering speed and efficiency without compromising accuracy. This comprehensive assessment method uses advanced technology and data analytics to provide reliable property valuations remotely, transforming the landscape of real estate evaluation.

Key Takeaways

• Desktop house valuation provides accurate property assessments without physical inspections, using digital data and comparable sales analysis

• This method typically delivers results in 24-48 hours compared to traditional valuations that can take 1-2 weeks

• Cost savings of 30-50% make desktop valuations an attractive option for many property transactions

• Advanced algorithms and market data ensure accuracy rates of 85-95% for standard residential properties

• Professional oversight by qualified surveyors maintains quality standards and regulatory compliance

What is Desktop House Valuation?

Desktop house valuation represents a modern approach to property assessment that leverages technology, data analytics, and professional expertise to determine a property’s market value without requiring a physical site visit. This innovative method combines automated valuation models (AVMs) with human oversight to deliver accurate, timely property assessments.

The Technology Behind Desktop Valuations

The foundation of desktop house valuation lies in sophisticated software systems that analyze vast amounts of property data. These systems access multiple databases containing:

- Recent comparable sales in the immediate area

- Historical price trends and market movements

- Property characteristics from official records

- Local market conditions and economic indicators

- Geographic information systems (GIS) data

Professional valuers use this technology as a powerful tool, applying their expertise to interpret results and ensure accuracy. The combination of artificial intelligence and human judgment creates a robust valuation process that meets industry standards.

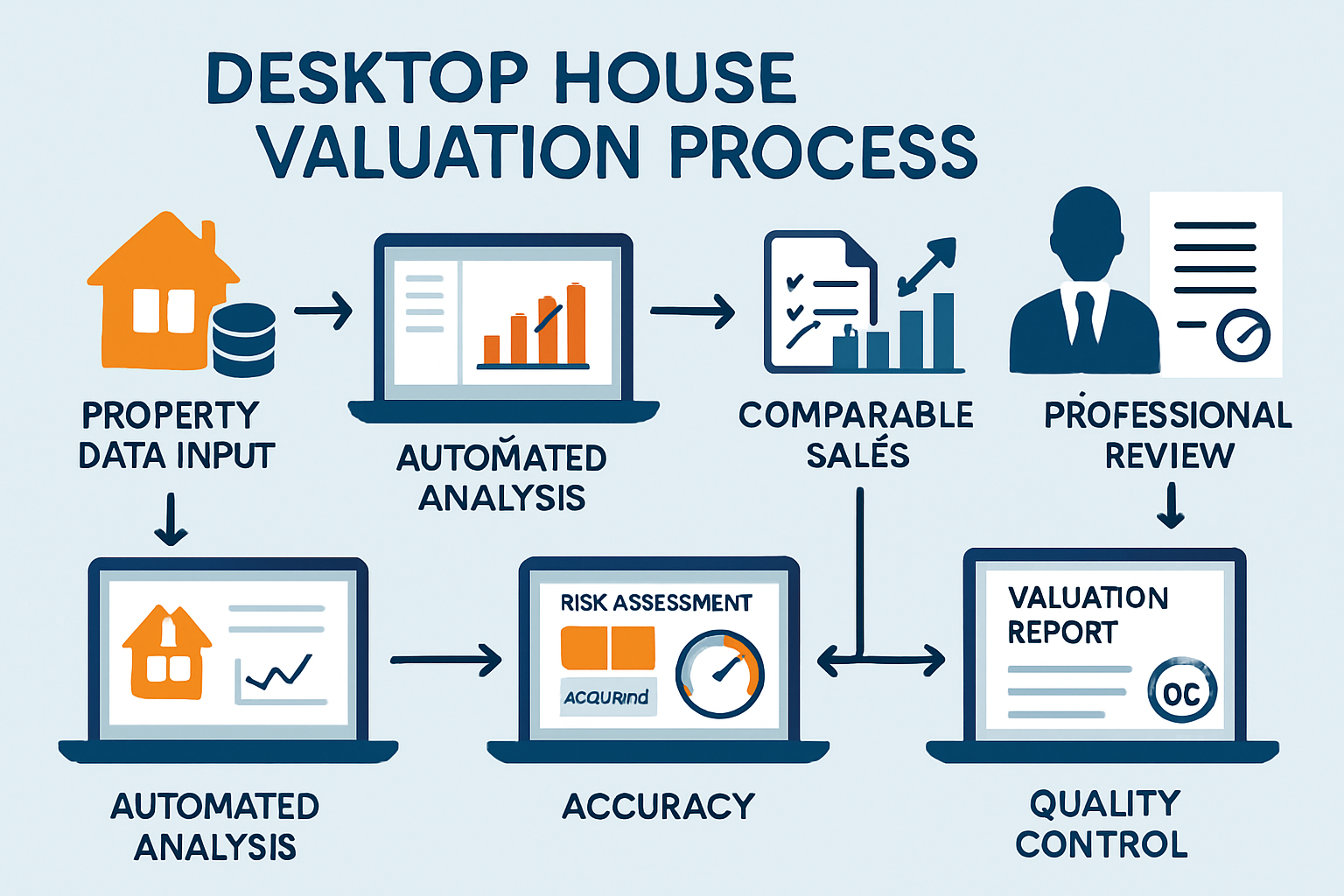

Key Components of the Desktop Valuation Process

The desktop valuation methodology incorporates several critical elements:

Data Collection and Analysis 📊

- Property databases and land registry information

- Recent sales transactions within the locality

- Market trend analysis and price movements

- Property-specific details and characteristics

Comparable Sales Assessment

- Identification of similar properties sold recently

- Adjustment factors for differences in size, condition, and features

- Location-specific market variations

- Time-based price adjustments

Risk Assessment and Quality Control

- Automated flagging of unusual results

- Professional review by qualified surveyors

- Confidence scoring and accuracy indicators

- Compliance with industry standards

How Desktop House Valuation Works

The desktop valuation process follows a systematic approach that ensures consistency and accuracy across all assessments. Understanding this methodology helps property owners and professionals appreciate the thoroughness of modern valuation techniques.

Step-by-Step Desktop Valuation Process

Initial Property Identification 🏠

The process begins with accurate property identification using official records and databases. This includes verifying the exact address, property type, and basic characteristics such as:

- Number of bedrooms and bathrooms

- Property size and plot dimensions

- Construction type and age

- Any notable features or extensions

Market Data Compilation

Advanced algorithms search through extensive databases to identify relevant comparable properties. The system considers:

- Properties sold within the last 6-12 months

- Geographic proximity (typically within 0.5-1 mile radius)

- Similar property types and characteristics

- Market conditions at the time of sale

Automated Analysis and Adjustment

The valuation software applies sophisticated mathematical models to:

- Calculate price per square foot adjustments

- Account for property condition variations

- Consider location-specific factors

- Apply time-based market corrections

Professional Review and Validation

Qualified surveyors review the automated results to:

- Verify the accuracy of comparable selections

- Apply local market knowledge

- Identify any anomalies or special circumstances

- Ensure compliance with professional standards

Quality Assurance in Desktop Valuations

Professional building surveyors maintain strict quality control measures throughout the desktop valuation process. These include:

| Quality Control Measure | Purpose | Frequency |

|---|---|---|

| Comparable verification | Ensure relevance and accuracy | Every valuation |

| Market trend analysis | Validate current conditions | Weekly updates |

| Professional oversight | Human expertise application | Every report |

| Accuracy monitoring | Track performance metrics | Monthly reviews |

| Client feedback analysis | Continuous improvement | Quarterly assessments |

Benefits and Limitations of Desktop House Valuation

Advantages of Desktop Valuations

Speed and Efficiency ⚡

Desktop house valuation dramatically reduces turnaround times, typically delivering results within 24-48 hours. This speed advantage proves crucial for:

- Time-sensitive property transactions

- Mortgage applications with tight deadlines

- Investment decisions requiring quick assessments

- Portfolio valuations for multiple properties

Cost-Effectiveness 💰

The streamlined process significantly reduces costs compared to traditional valuations:

- Lower surveyor travel expenses

- Reduced time investment per valuation

- Economies of scale for multiple properties

- Competitive pricing for standard assessments

Accessibility and Convenience

Desktop valuations eliminate scheduling constraints and access issues:

- No need to coordinate property visits

- Suitable for vacant or occupied properties

- Available during standard business hours

- Reduced disruption to property occupants

Consistency and Standardization

Automated systems ensure consistent application of valuation methodologies:

- Standardized comparable selection criteria

- Uniform adjustment calculations

- Reduced human error potential

- Traceable decision-making processes

Limitations and Considerations

Property-Specific Constraints 🚧

Desktop valuations may not be suitable for all property types:

- Unique or unusual properties with limited comparables

- Properties requiring condition assessment for structural issues

- Historic or listed buildings with special characteristics

- Properties with significant modifications not reflected in records

Market Condition Dependencies

The accuracy of desktop valuations depends on stable market conditions:

- Rapidly changing markets may affect comparable relevance

- Limited recent sales data in some areas

- Seasonal variations in property values

- Economic uncertainty impacting market stability

Regulatory and Professional Standards

Some situations require traditional valuations:

- Court proceedings and legal disputes

- Certain mortgage lender requirements

- Insurance claim assessments

- Professional negligence considerations

For properties requiring detailed physical inspection, traditional survey methods remain the preferred option.

When to Choose Desktop House Valuation

Ideal Scenarios for Desktop Valuations

Mortgage and Refinancing Applications 🏦

Desktop house valuation proves particularly effective for standard residential mortgage applications where:

- The property is a typical residential dwelling

- Recent comparable sales exist in the area

- The loan-to-value ratio is conservative

- Lenders accept desktop valuation reports

Investment Portfolio Management

Property investors benefit from desktop valuations for:

- Regular portfolio monitoring and assessment

- Buy-to-let property evaluations

- Capital gains tax calculations

- Investment strategy planning

Quick Market Assessments

Desktop valuations serve well for preliminary assessments:

- Initial property pricing for sales

- Market value verification before purchase

- Insurance valuation updates

- Estate planning purposes

When Traditional Valuations Are Necessary

Complex Property Types 🏛️

Certain properties require physical inspection:

- Commercial and industrial properties

- Listed buildings and historic properties

- Properties with unusual construction methods

- Homes with significant structural modifications

Legal and Court Proceedings

Traditional valuations are typically required for:

- Divorce settlements and asset division

- Probate and estate administration

- Compulsory purchase compensation

- Professional negligence claims

Detailed Condition Assessment

Physical inspections become necessary when:

- Structural concerns exist

- Property condition affects value significantly

- Insurance claims require damage assessment

- Building survey requirements must be met

Accuracy and Reliability of Desktop House Valuation

Performance Metrics and Industry Standards

Desktop house valuation accuracy has improved significantly with advances in technology and data availability. Industry research indicates that well-executed desktop valuations achieve accuracy rates of 85-95% for standard residential properties in areas with sufficient comparable sales data.

Factors Affecting Accuracy 📈

| Factor | Impact on Accuracy | Mitigation Strategies |

|---|---|---|

| Comparable availability | High | Extended search radius, longer time periods |

| Market volatility | Medium | Frequent data updates, trend analysis |

| Property uniqueness | High | Professional override, traditional valuation |

| Data quality | Medium | Multiple source verification, quality checks |

| Local market knowledge | Medium | Professional surveyor review |

Quality Control Measures

Professional valuation firms implement multiple quality control layers:

Automated Checks 🤖

- Statistical outlier detection

- Comparable relevance scoring

- Market trend consistency verification

- Data accuracy validation

Professional Oversight

Qualified surveyors provide essential human expertise:

- Local market knowledge application

- Professional judgment for unusual circumstances

- Quality assurance review processes

- Client communication and explanation

Continuous Improvement

Leading firms monitor and enhance their desktop valuation processes through:

- Regular accuracy testing against actual sales

- Client feedback incorporation

- Technology updates and improvements

- Professional development and training

Confidence Levels and Risk Assessment

Modern desktop house valuation systems provide confidence indicators that help users understand the reliability of each assessment:

High Confidence Valuations (90%+ accuracy)

- Standard residential properties

- Areas with abundant comparable sales

- Stable market conditions

- Recent transaction data available

Medium Confidence Valuations (80-90% accuracy)

- Properties with some unique features

- Areas with moderate comparable availability

- Slightly volatile market conditions

- Older transaction data

Low Confidence Valuations (Below 80% accuracy)

- Unique or unusual properties

- Limited comparable sales data

- Highly volatile market conditions

- Significant data gaps or quality issues

Choosing the Right Desktop House Valuation Service

Key Selection Criteria

Professional Qualifications and Accreditation 🎓

When selecting a desktop valuation service, verify:

- RICS (Royal Institution of Chartered Surveyors) membership

- Professional indemnity insurance coverage

- Relevant experience in local markets

- Compliance with industry standards

Technology and Data Sources

Evaluate the provider’s technological capabilities:

- Access to comprehensive property databases

- Advanced analytical software and algorithms

- Regular data updates and maintenance

- Integration with multiple information sources

Turnaround Times and Service Levels

Consider operational aspects:

- Standard delivery timeframes

- Rush service availability

- Communication and support quality

- Report format and presentation

Cost Considerations

Desktop house valuation costs vary based on several factors:

Standard Pricing Structure 💷

- Basic residential valuations: £150-£300

- Complex properties: £250-£500

- Portfolio valuations: Discounted rates available

- Rush services: Premium charges apply

Value-Added Services

Some providers offer additional services:

- Market trend analysis and commentary

- Rental valuation assessments

- Insurance replacement cost calculations

- Regular monitoring and updates

Professional firms like Notting Hill Surveyors provide comprehensive valuation services with transparent pricing and professional oversight.

Questions to Ask Potential Providers

Before selecting a desktop valuation service, consider these important questions:

- What qualifications do your valuers hold?

- Which databases and information sources do you access?

- How do you ensure quality control and accuracy?

- What is your typical turnaround time?

- Do you provide confidence ratings with your valuations?

- What happens if the valuation is challenged or disputed?

- Are there any additional fees or charges?

The Future of Desktop House Valuation

Technological Advancements

The desktop house valuation industry continues to evolve with emerging technologies:

Artificial Intelligence and Machine Learning 🤖

- Enhanced pattern recognition in property data

- Improved accuracy through continuous learning

- Better handling of complex property characteristics

- Automated quality control improvements

Big Data Integration

- Incorporation of additional data sources

- Social and economic indicators analysis

- Environmental factors consideration

- Real-time market condition monitoring

Satellite and Aerial Imagery

- Property condition assessment from imagery

- Automated measurement and verification

- Change detection over time

- Enhanced comparable property analysis

Industry Trends and Developments

Regulatory Evolution 📋

The regulatory landscape continues to adapt to technological advances:

- Updated professional standards for digital valuations

- Enhanced consumer protection measures

- Standardized reporting formats

- Quality assurance requirements

Market Acceptance

Desktop valuations gain broader acceptance across various sectors:

- Increased lender adoption for standard mortgages

- Growing use in commercial property sectors

- Integration with property technology platforms

- Enhanced client education and understanding

Professional Development

The surveying profession adapts to technological change:

- Specialized training in digital valuation methods

- Hybrid approaches combining traditional and desktop techniques

- Enhanced data analysis skills development

- Technology-enabled service delivery

Preparing for Future Changes

Property professionals and consumers should prepare for continued evolution in desktop house valuation:

Staying Informed 📚

- Monitor industry developments and best practices

- Understand changing regulatory requirements

- Evaluate new service providers and technologies

- Maintain awareness of market trends

Skill Development

- Enhance digital literacy and technology understanding

- Develop data analysis and interpretation skills

- Understand the limitations and appropriate applications

- Maintain professional development commitments

For those seeking comprehensive property assessment services, exploring various survey types can help determine the most appropriate approach for specific needs.

Conclusion

Desktop house valuation has emerged as a transformative force in the property assessment industry, offering unprecedented speed, efficiency, and cost-effectiveness for standard residential valuations. With accuracy rates reaching 85-95% for typical properties and turnaround times of just 24-48 hours, this technology-driven approach addresses many of the traditional challenges associated with property valuation.

The success of desktop valuations lies in their sophisticated combination of advanced data analytics, comprehensive market databases, and professional oversight by qualified surveyors. This hybrid approach ensures that while technology drives efficiency, human expertise maintains quality and accuracy standards.

However, desktop house valuation is not a universal solution. Properties with unique characteristics, complex structural issues, or those requiring detailed condition assessments still benefit from traditional physical inspections. The key lies in understanding when each approach is most appropriate and selecting qualified professionals who can guide this decision-making process.

Next Steps for Property Owners and Professionals

For Property Owners:

- Assess whether your property suits desktop valuation methods

- Research qualified providers with appropriate professional credentials

- Understand the limitations and confidence levels of desktop assessments

- Consider desktop valuations for routine monitoring and preliminary assessments

For Property Professionals:

- Stay informed about technological developments and industry best practices

- Develop expertise in both traditional and desktop valuation methods

- Maintain professional development to adapt to changing market needs

- Educate clients about appropriate applications for different valuation types

For Investors and Lenders:

- Evaluate desktop valuation policies and risk management procedures

- Consider the cost-benefit advantages for standard property types

- Implement quality control measures and professional oversight requirements

- Monitor accuracy and performance metrics for continuous improvement

The future of property valuation lies in the intelligent integration of technology and professional expertise. As desktop house valuation continues to evolve, it will play an increasingly important role in making property assessment more accessible, efficient, and responsive to market needs.

For professional guidance on property valuation and survey services, consider consulting with experienced surveyors who can provide expert advice tailored to your specific requirements and circumstances.