When you are buying a property, you can hire a surveyor from CIOB, RPSA and the Royal Institution of Chartered Surveyors (RICS) to prepare an RICS Level 2 Homebuyer Report for you. This is a popular type of property report in the UK and covers all aspects of the property. The report will provide you with detailed information on the property’s construction and condition, and it will identify significant defects and urgent issues that affect the property’s value. You can also ask your surveyor to focus the report on specific problems that concern you, which is a good idea if you’re unsure about something related to the property.

The report will assess the property’s market value, the cost to rebuild it, and the report will also help you to understand the property’s overall marketability. The Level 2 Homebuyer Report does include a rough property valuation. However, you can request a more accurate valuation from a valuer separately if you want one.

Whether buying freehold or leasehold, purchasing a property in Notting Hill is unlike any other place in the country. Thus, you must understand the nature of your investment before relinquishing your savings and so a critical part of the process is obtaining an RICS homebuyer survey. In Notting Hill, such surveys are almost indispensable. They essentially serve to inform you of the property’s condition and let you know if any urgent repairs might or might not be necessary. Of course, any good survey should point out the basic healthy and unhealthy signs of the property. In conjunction with such surveys, it is also good to know what Notting Hill’s typical problems are.

The average buyer in Notting Hill might expect to pay around £700 for a home buyer survey arranged through us. The RICS offers several different levels of service when it comes to this kind of survey. The two most common levels are RICS Level 2 and RICS Level 3 with the latter being more detailed.

If you plan to purchase a new home—be it your first or an addition to your current situation—then you would do well to consult the Notting Hill-based team of chartered surveyors. They offer the best service for the money and a quality report that assures you of the condition of the property you are interested in. We therefore recommend a well-executed property survey as a must-have when buying into the Notting Hill property market.

Our panel of Chartered Surveyors in Notting Hill encounter various problems when surveying residential properties. Among these, the most prevalent are building defects, planning disputes, and utilities problems. In today’s discussion, we also consider with the reason why they’re so common and the fact that too few property buyers in Notting Hill are obtaining pre-purchase surveys! Indeed, only one in five residential property purchasers in Notting Hill opt for the protection of a Chartered Survey, a truly astounding statistic when you consider that Notting Hill is home to numerous historic properties and is part of several conservation areas.

Choosing a property requires considering many factors. This makes obtaining an RICS HomeBuyer Report truly valuable.

Overview: it brings you peace of mind by letting you know whether or not the property has structural issues—dampness being one of the more common problems—and allowing you to encounter otherwise hidden issues ranging from the property’s floor to its roof. You’ll learn about necessary repairs and replacements.

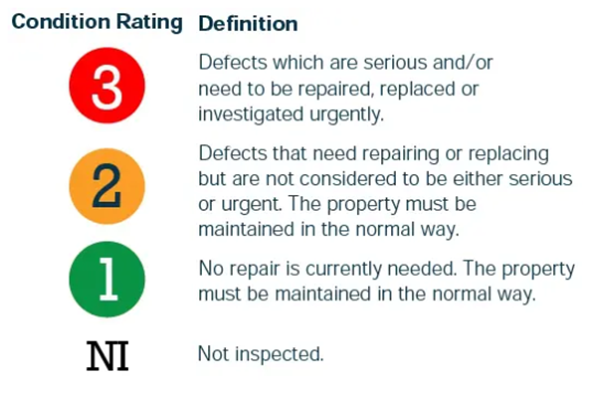

Traffic Light System: there are three colour-coded condition ratings for the property, which will help you make decisions.

Market Valuation: besides the report, you also have the option of a market valuation conducted by an RICS registered valuer (for an additional fee, although it will be less than what an individual valuation would cost). This assures you that you are paying an appropriate price for the property based on the current condition of the property, as well as the local market. If you are involved in marital or legal matters, it is essential to have an appraisal of your home that conveys an accurate, up-to-date worth in writing.

Reinstatement Cost Assessment: based on the information you give, our panel of surveyors provide a building cost for the property for insurance purposes (this will be at an additional cost, but will be greatly discounted against a standalone valuation), which is mandatory for ensuring you are fully insured should anything happen.

Identification of Risks: you can pinpoint likely legal problems that could adversely affect the property’s value.

Negotiation: the inspection period gives you some insight into what you should address with the seller and what you can use as leverage in negotiations pertaining to the price of the home.

Peace of Mind: above all, a CIOB, RPSA or RICS HomeBuyer Report provides reassurance. It lets you know the state of the property into which you’re about to pour a large amount of cash, and that can certainly help reduce the stress levels associated with this major life event.

Mortgage Approval: some mortgage lenders won’t approve your application unless you get a survey from some group that they recognise, and CIOB, RPSA or RICS fits that bill. So the HomeBuyer Report qualifies as a survey for a number of important reasons.

Long-Term Savings: getting a Home Buyer Report involves paying a fee, but in the long run it can save you money. This is because the report—prepared by a CIOB, RPSA or RICS Chartered Surveyor—thoroughly identifies any issues with the property that you might not have caught yourself. Of course, if you’re buying a brand new home, it might seem unnecessary to have a sort of “check-up” done on it, but even new homes can have problems that should be nipped in the bud before they grow into something serious and expensive.

Professionalism: when potential buyers see things with a report which they might not have foreseen without, it gives them an easy opportunity to reduce the price of the property. This is especially the case when things that are spotted need substantial work. In a nutshell, a HomeBuyer report done by a CIOB, RPSA or RICS surveyor is quite thorough and covers important information about a property.

To put it another way, you end up with a report that allows you to have a solid sense of a property’s condition and its value. The value is pegged to the date of the inspection.

For properties and flats in Notting Hill, a Homebuyer Survey starts at £700. The typical fee for a three-bedroom house is around £850. The full Building Survey, conducted by a surveyor from the Royal Institution of Chartered Surveyors (RICS), Chartered Institute of Building (CIOB) or Residential Property Surveyors Association (RPSA), would go one step further by checking for potential issues that could cause significant concerns in the future, like structural movement (subsidence), dampness, and really severe problems both inside and outside the house. It is therefore a good idea to get the cost-value aspect of the property checked by the surveyor.

The most standard condition report for a home is the RICS HomeBuyer Report (Level 2), which runs approximately from about £700 to £1,300. It provides a general assessment of the property’s condition and points out anything that could potentially affect its value. The RICS HomeBuyer Report does not focus on the minute details, as it is not a snagging survey; rather, it gives an overall picture of the problems. To accomplish this, the report employs a traffic light rating system that indicates the severity of the property’s defects and safety issues.

For larger buildings, a “RICS Level 3 Building Survey” might run you between £800 and £1,500, with some rare instances pushing the cost even higher. Because this survey offers a detailed breakdown of any defects, it is not your least expensive option. If, for instance, your building is at the top of a hill with a steep, sloping yard, or the property is large, expensive, old or even newly built, then a Level 3 RICS building survey is definitely the right call and will let you know if there’s been any movement in the foundation.

Surveys that are more in-depth and of better quality do cost more, but they could ultimately save you certain amounts of cash if they allow you to avoid potential costly issues in the future. If you have your eyes on a property in Notting Hill, a homebuyer’s or full building survey would be a good investment.

Our panel is composed of expert and local RICS surveyors in Notting Hill, who are experienced in conducting residential property surveys.

The surveyors provide several types of services, including a HomeBuyer Survey and Valuation. This inspection is more thorough than the average home inspection and tends to focus more on the potential impact (positive or negative) that certain property conditions might have on the property’s value.

Accreditation/qualification: The Notting Hill Surveyors panel consists of qualified, experienced chartered building surveyors accredited by RICS, CIOB or RPSA. The Royal Institution of Chartered Surveyors is a global professional body of over 200,000 members, the preeminent authority on professional land, real estate, construction, and environmental issues. Other members of our panel of surveyors belong to accreditation bodies that are similarly influential and issue similar accreditations. All of these accreditations and memberships can be seen as marks of the highest possible standards of expertise and integrity in the valuation, management, and development of professional land, real estate, construction, and environmental issues.

Specialty: the group of surveyors provides clear and direct opinions on property conditions and values. They are unfailingly familiar with the unique aspects of Notting Hill property. Their work is of the highest quality and involves an incredible amount of detail. The inspection is visual and takes place in all accessible parts of the building. Any potential problems are clearly noted, from serious issues like subsidence or dampness to much less worrisome problems like missing caulk in shower stalls. To avoid trouble after purchasing a property, buy a detailed report to know of any serious or potentially expensive problems that exist before the sale goes through.

Clarity: the inspection yields a report that is easy to read, free of jargon, and clear in its comprehensiveness. If defects are found, the report details them and provides professional advice on repairs and maintenance. These features make the report a useful, potent tool during any negotiations concerning the price of a property.

Post survey support and advice: your surveyor should not merely hand you a report at the end and then take their leave. They ought to offer as part of their service, a post-survey consultation. In this, you can go through the report together, discuss its content and potential ramifications, and receive some handy advice as to what it all might mean for you in the near future.

Value for Money: getting a HomeBuyer Report is an extra cost, but it can actually help save you money in the long term. If any problems show up in the report, you now have the opportunity to either negotiate for the seller to fix the problem or get a price reduction. Both choices help counteract the home’s cost issues.

To ensure you can select your new home wisely, engage well-respected surveyors to conduct the HomeBuyers Survey! The Notting Hill property market is among the most diverse, and it’s one of the fastest paced of the price bracket in the whole UK. Thus, it is essential to have a professional take you—from the outside appearance of the home down to its structural bones.

The Notting Hill property market is complex. Thus, before any decisions are made, it is always good practice to gain valuable insight. A Home Buyer’s Report, supplied by your qualified chartered surveyor, will do just this, giving you an authoritative, accurate, and up-to-date perspective on the property to assist you in making the correct decision for your family and your future.

For a mere £700, you can secure the services of a CIOB, RPSA or RICS HomeBuyer Report, granting you peace of mind regarding the financial future of your property and the comfort and safety of your family. This survey can also potentially save you thousands of pounds off the price of your property. The team of surveyors currently provides two distinct options for residential property survey reports. The RICS HomeBuyer Report is the most basic offering, and we also provide the very comprehensive Level 3 Survey and Roof Surveys. You are welcome to contact us for a propitious quotation on any survey you may choose from this suite of services.

RICS’s industry guidelines suggest building surveys for properties that are large, very old, in some disrepair, or have unusual features. Building surveys are also recommended if you plan to do any significant renovations or extensions.

If you’re purchasing a relatively modern home that’s in decent shape and built to ordinary standards, then a Home Buyer Survey is an acceptable choice. If you want the assurance of an inspection and report that are pretty much guaranteed to turn up any issues that might be hidden or just hard to see, then you should go for a Full Building Survey instead.

The Full Building Survey is more detailed; it is more specifically tailored to the property your surveyor would be inspecting. It also comes with more advice on the visible defects found and on the potential hidden defects that they suspect may be present. Your surveyor will illustrate reports with photographs so that you can clearly see what has been discovered. Both the Home Buyer and Full Building Surveys describe the repairs needed, the order in which the repairs should be done, and the kind of “maintenance measures” that will be required to keep the property in good condition.

A HomeBuyer Report does include a market valuation as well as reinstatement costs. However, a Full Building Survey does not. The main reason for the differences in what is and isn’t included in the two types of reports is how focused the reports are on the condition of the property. The Full Building Survey is the most in-depth and comprehensive survey of a property that you can have done.

The survey can return one of two general results. It can say that all is well or it can return a list of defects, allowing you an opportunity to still walk away from the purchase, negotiate a lower figure, or have the seller carry out the necessary repairs.

If any major issues turn out to be part of the defects list (and major issues can mean something as serious as no basement waterproofing), then the surveyor should advise on what to do. Major issues can also mean a serious impact on the structural integrity of the building, and the conversation with the surveyor can help the potential buyer gauge how much it’s going to hit them in the pocketbook to fix it.

Looking for a Chartered Surveyor? If you are buying a property, contact us for a building survey. Our panel of CIOB, RPSA and RICS surveyors will help you with the Level 2 or Level 3 property survey you need in Notting Hill. We can also assist you in Red Book Valuations, Party Wall Awards and other services. Reach out to us today for building surveyors, valuers and party wall surveyors in London!